Is Wise card safe in Ireland and abroad?

This article is all about the safety of Wise card. Discover all the security measures you can add to your Wise account and card.

If you’re moving to the UK to study, live or work - or if you visit there often - being able to spend and make payments in GBP cheaply and easily is crucial. Having a UK bank account can cut your overall costs and make it easier to access services when you’re in the UK - and to make the transition as easy as possible, you may be thinking of moving to one of the Irish banks with UK branches to cover you when you move.

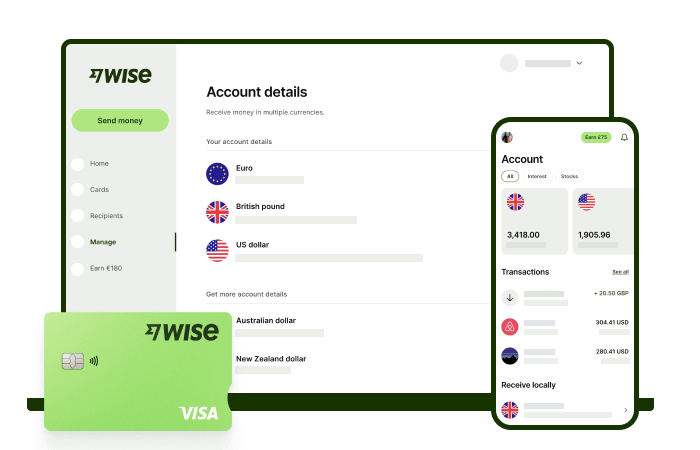

This guide looks at a couple of popular Irish banks in the UK and also presents another possibility: the Wise Account. With a Wise Account you'll be able to manage euros and pounds in the same account, convert, spend, send and exchange with the mid-market rate, and get the Wise card to pay for things at home and abroad.

Yes. There are a couple of options if you want to move your Irish bank account over to the UK, including Bank of Ireland and AIB.

These banks have slightly different services in the UK, including different products, fees and features, so it’s important to get familiar with your options before you move your account.

The access you have to branches will also depend on whether you’re living in or travelling to Northern Ireland, or Great Britain.

This guide covers some basics to know about.

Bank of Ireland UK¹ offers personal account services, mortgages, savings and loans.

Their branch network in the UK is in Northern Ireland only, but you can continue to use your account in Great Britain once you have it set up. You’ll be able to manage key services like depositing cash through the UK’s Post Office network, which lets you continue to use your account if you move over to Great Britain.

Whether you can shift your Irish account to the UK, or you need to close one account and open a new one, may depend on the specific account product you have.

Contact Bank of Ireland UK to learn more on 0345 850 1234 from Great Britain, or 0345 6016 157 from Northern Ireland.

AIB offers business services in the UK, and if you have a business relationship with the bank you can also access some personal account services.²

While AIB does have a physical presence in Belfast and London, Allied Irish Bank branches UK are only for trade finance and business use. Personal account services are not supported, but you can still continue to use your account easily enough through the UK’s Post Office network³.

If you have a business account with AIB and would like to add in personal account options, or if you’re thinking of moving your account to the UK, you can get in touch with AIB UK on 0345 600 5204 to discuss.

Generally UK banks can offer some account products for non-residents, but these may not be the same accounts that are offered for residents. This means that what’s available for you might depend on whether you already live in the UK, or you intend to move there shortly.

For example, Barclays offers specific support for people who are moving to the UK in the next 90 days.⁴ This might allow you to open an account before you move.

If you’re not moving to the UK spoon - or not planning on relocating at all - the chances are that you’ll be pointed to a UK bank’s international banking division. Accounts here can be pretty flexible in terms of currencies and services, but they also often have high account fees and a minimum balance you need to maintain.

To give an example, Lloyds Bank in the UK recommends the International Plus Account⁵ - but this has a 20 GBP monthly fee unless you hold 10,000 GBP in your account at all times.

HSBC UK might let you open an account from abroad - but you’ll need to select an account and then complete the online form to check your eligibility.⁶ If you’re not eligible you’ll likely be directed to one of their international and expat accounts, which can be more restricted and expensive than a regular bank account.

| Read more: Can I open a UK bank account from Ireland? |

|---|

Using an Irish bank in the UK may not suit your needs - and opening a standard UK account without a suite of local paperwork and a UK address could be a pain. As an alternative, check out the Wise Account.

Open your Wise account online, whether you’re in Ireland or the UK to hold and manage GBP, EUR and 40+ other currencies. You can also get the Wise card for seamless spending and withdrawals at home and abroad.

Wise uses the mid-market exchange rate, and low transparent fees to convert currencies. You’ll also have local account details to receive payments in 8+ currencies including EUR, GBP, USD, AUD and more.

When you need to send money to or from the UK - or 140+ other countries - Wise can help with that, and you can check and compare all the fees before you confirm.

See if Wise can help with easy currency conversion and spending, before you relocate, on arrival, or as a visitor to the UK.

Open your personal

Wise Account for free 🚀

If you’ve moved to the UK already you should have no problem opening an account with a UK bank as long as you have an eligible ID and a proof of UK address. Usually that’ll mean showing your passport or photo driving license to prove your identity, and then a utility bill or official letter to show your UK address.

If you’re able to provide these documents, then this is how to get started:

- Compare the accounts you prefer, and check you meet the eligibility criteria

- Gather your documents based on the account you’ve selected

- Complete your application online, or have a member of the branch team help you if you prefer

- Upload or show your documents for verification

- You may need to pay a minimum opening deposit to activate your account

Looking for more on opening a non-resident account for the UK? Check out this guide to opening a UK bank account from Ireland.

There you have it. Depending on your personal preferences and residency, you may be able to open an account in the UK with an Irish bank, or get a UK account from Ireland.

Before you decide, compare your options against Wise to see if you could save with low cost international account and card services which use the mid-market rate.

Sources used:

Sources last checked on date:

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

This article is all about the safety of Wise card. Discover all the security measures you can add to your Wise account and card.

If you need to access the banking system in the USA, looking for Irish banks might be a possibility. Read this article to check your options.

If you want to know what kind of card the Wise card is, this article will explain everything.

What is the best PayPal alternative in Ireland? Check out this list and see for yourself.

Is it possible to buy Swiss francs online? Discover where you can do this and how much it costs.

What is the process to import a car from Northern Ireland? Discover in this guide.