How to get a Hong Kong passport for foreigners?

Want a Hong Kong passport as a foreigner? Learn the naturalisation process, permanent residency, and eligibility. Discover how to apply.

MPF stands for Mandatory Provident Fund. The MPF in Hong Kong helps citizens and residents save for their retirement through a selection of individual, employer sponsored and industry schemes. If you’re working in Hong Kong, the chances are that both you and your employer will make contributions to an MPF scheme - you can also choose to make voluntary contributions to give your nest egg a boost.

In this guide we’ll cover how MPF schemes work, including the MPF Hong Kong calculation for contribution levels, and some of the ins and outs of the MPF for foreigners. We’ll also introduce Wise as a smart option to make low cost international payments as an expat - including lower fees if you need to withdraw your MPF fund early when you leave Hong Kong.

MPF is the Hong Kong Mandatory Provident Fund.

The MPF is a mandatory, privately managed fully funded contribution system which is part of Hong Kong’s retirement protection structure, and was launched in 2000.¹ The most common MPF schemes are Master Trust Schemes.² These can be opened by employers, employees, self employed people and those who want to open a personal or voluntary contribution account. Master Trust Schemes can include:

There are also employer sponsored schemes, and industry schemes, which are available to people based on their type of employment. Employer sponsored MPF schemes are available only to employees of a specific company, while industry schemes are primarily in place for casual workers in catering and construction.

You can learn lots more about MPF schemes, fund types and features, on the MPFA website. There are also a range of handy tools like a retirement planning calculator which can help you build a picture of how your MPF scheme can work for you in future.³

Employers and employees are both required to make mandatory contributions to the employee’s MPF account. This must be at least 5% of the employee’s relevant income, subject to minimum and maximum caps.⁴ Contributions for self-employed people are also set at a mandatory 5% of relevant income.⁵ On top of the mandatory MPF payments, you can choose to make extra voluntary contributions to top up your account.

An employee can claim a tax deduction for contributions they make to an MPF scheme, subject to a maximum cap of 18,000 HKD.⁶ Voluntary contributions may or may not be tax deductible, depending on the specifics of the payment and MPF scheme.

ORSO stands for Occupational Retirement Schemes Ordinance.

In general, ORSO and MPF are both pension protection schemes for employees. While MPF is mandatory and regulated by laws, ORSO is a voluntary, employer-driven plan. With ORSO, employers can customize schemes based on their business needs and structure. Since ORSO is often tailored, ORSO will have more flexibility than MPF in many areas. For example, ORSO does not limit the age of participants like MPF. There is also no fixed cap to the amounts that can be contributed like MPF. Sometimes, having an ORSO plan in place may exempt participants from making MPF contributions and claiming related tax deductions.

Mandatory MPF Hong Kong employer contributions are deposited by the employer directly into the employee’s MPF account. The employee contribution is also deducted from salary payments, subject to the minimum and maximum income caps. This means that although the employer must always make an MPF contribution, employees earning under 7,100 HKD a month do not need to make mandatory payments.

The MPF Hong Kong maximum contribution is 1,500 HKD per month from both the employer and the employee. That’s because relevant income is only assessed up to the cap of 30,000 HKD a month. Here’s how the mandatory MPF contribution system works:

| Monthly income | Employer MPF contribution | Employee MPF contribution |

|---|---|---|

| Under 7,100 HKD | 5% of relevant income | Not required |

| 7,100 - 30,000 HKD | 5% of relevant income | 5% of relevant income |

| 30,000 HKD or more | 1,500 HKD | 1,500 HKD |

Depending on the type of MPF scheme you select, you may also be able to make tax deductible voluntary contributions to your account.⁷

MPF relevant income includes all payments from your employer, such as your salary, commissions, bonuses, overtime pay, allowances, and other types of payments. This figure is used to calculate how much you and your employer must contribute to your MPF. Severance and long service payments are not included.

MPF relevant income includes, but is not limited to:

Some businesses or individuals might voluntarily contribute to the MPF more than required.

Why? Making an MPF voluntary contribution allows you to save more for retirement beyond the mandatory amount. It's an effective way to boost your savings and potentially lower your taxes in some cases. Here are the types of voluntary contributions:

Employer and employee both are required to contribute to the MPF scheme. And, MPF first contribution refers to the initial payment made by both the employer and employee.

Employers are required to make their MPF first contribution for their new employees on or before the next contribution day, which is the 10th day of each month, after the calendar month in which the 60th day of employment falls. And, the calculation of an employer’s contribution for that employee starts from the first day of the employee’s employment. Meanwhile, the employee doesn’t need to contribute anything to the MPF during their first 30 days of employment or the first incomplete payroll period that follows the first 30-day period. It might sound confusing, but let’s look at an example to understand this idea.

Let’s suppose your employment starts from June 23, 2025. Here is how much and when employer and employee need to contribute:

| Period | Employer Contribution | Employee Contribution |

|---|---|---|

| June 23 – June 30 | 5% | Not required |

| July 1 – July 22 | 5% | Not required |

| July- 23 - July 31 | 5% | Not required |

| August 1 onward | 5% | 5% |

In this specific case, the deadline for employers to submit the first MPF payment is on or before September 10, 2025. The payment needs to include the period from June 23 to August 31.

It is common for a person to have multiple MPF accounts, but having several accounts can be inconvenient and hard to manage, as you may receive letters and documents from various MPF trustees from time to time. At one point, you might forget how many or which fund you have and invest or even how much money you are investing.

The good news is you can consolidate all your MPF accounts by following three simple steps:

Of course, many people will only start to withdraw their MPF funds upon retirement. But what if you’re moving away? Can I withdraw my MPF early? In this case you may be eligible for MPF Hong Kong early withdrawal.

If you are moving away, early withdrawal is only available if you’re permanently leaving Hong Kong. You must have left already, or intend to leave soon, and make a statement confirming you will not return to Hong Kong for work or to settle as a permanent resident. It’s worth noting that MPF won’t be paid again if you withdraw your funds and then reapply to your provider under the same reason but with a later date of leaving.

You’ll need to apply to the relevant MPF scheme to withdraw funds, and will be expected to provide:⁸

According to the MPF Schemes Authority, if you had been paid MPF on grounds of permanent departure from Hong Kong, you cannot apply with a later departure date again. If you return to Hong Kong subsequently and become employed or self-employed, you have to enrol in MPF schemes again.

Previously, the MPF offsetting scheme helped ease the financial burden on businesses by allowing them to deduct severance and long service payments from their contribution to an employee’s MPF account. In effect, it meant part of the employee’s retirement savings was used to cover termination benefits. However, it is no longer the case now.

From May 1, 2025, MPF Offsetting Scheme is completely abolished: employers can no longer use their MPF contribution to offset severance and long service payments. On top of MPF contributions, severance and long service payments need to be paid in full by the employer. This will protect employees’ retirement savings when they no longer work in Hong Kong. Employees can receive full payment from severance or long term service payment entitlement in case of layoffs or redundancy, without touching their MPF amounts.

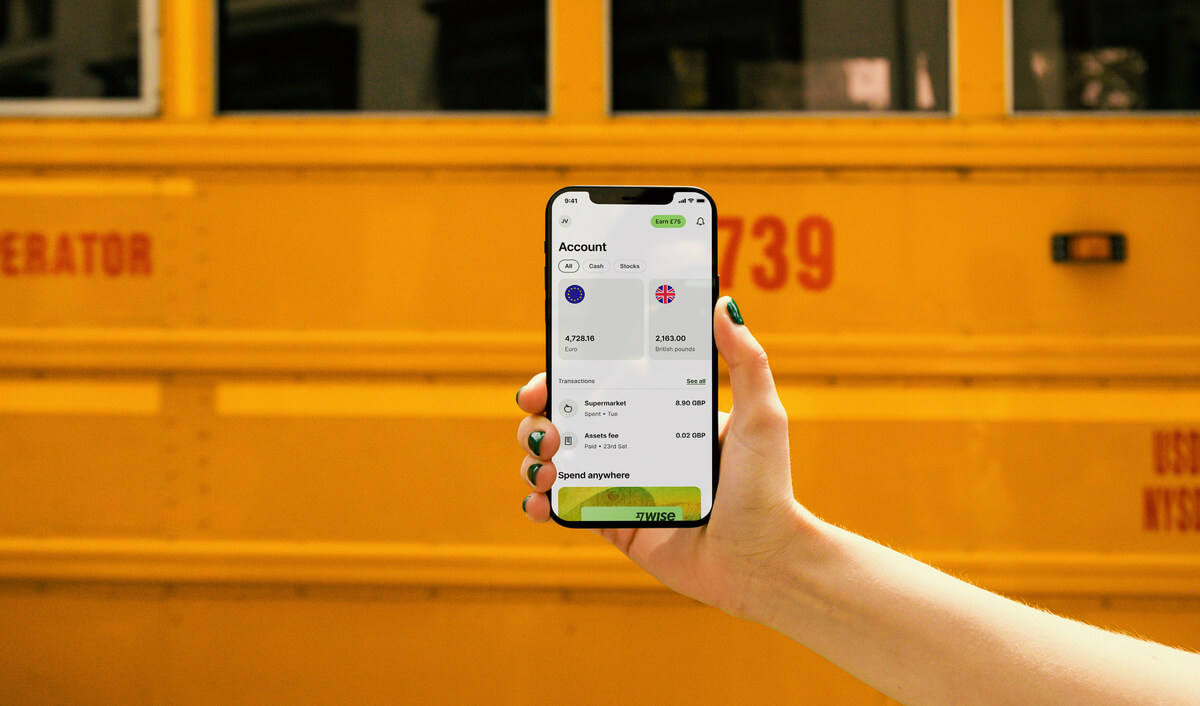

Going through the MPF Hong Kong expat withdrawal process? If you’re withdrawing your MPF funds early, or need to send a payment overseas for any other reason, choose Wise international payments to get the real exchange rate and low, transparent fees every time.

No matter where in the world you’re sending your MPF funds, with Wise you’ll always get the mid-market exchange rate with no markup, no margin and no hidden fees. There’s just a low, transparent charge, and your money can arrive at its destination in double quick time. See how much you can save with Wise today.

If you’re working in Hong Kong, you’re likely to need to get to know the MPF system. Use this guide as an introduction, and if the time rolls around when you’re moving away and need to withdraw your MPF funds early, use Wise to get the best available deal on your international transfer.

Sign up and save with Wise now

Sources last checked on 25-Jun-2025

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Want a Hong Kong passport as a foreigner? Learn the naturalisation process, permanent residency, and eligibility. Discover how to apply.

The IANG visa is a scheme to encourage non-local students to stay or return to work in Hong Kong. Read this guide to learn more about the IANG visa.

This guide will give you all the essential information to apply for a dependent visa in Hong Kong to bring their families to the city.

This guide runs through when long service termination payments may be used, who could be eligible and how much should be paid.

This guide runs through what you need to know about Hong Kong permanent residence

We’ll cover where to start your search, which districts are popular and how much on average you’ll need to pay.